This website uses cookies to help improve your user experience

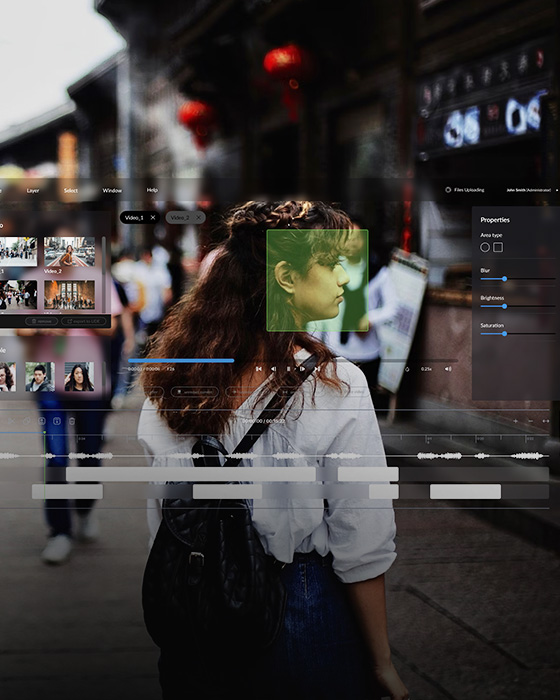

Video

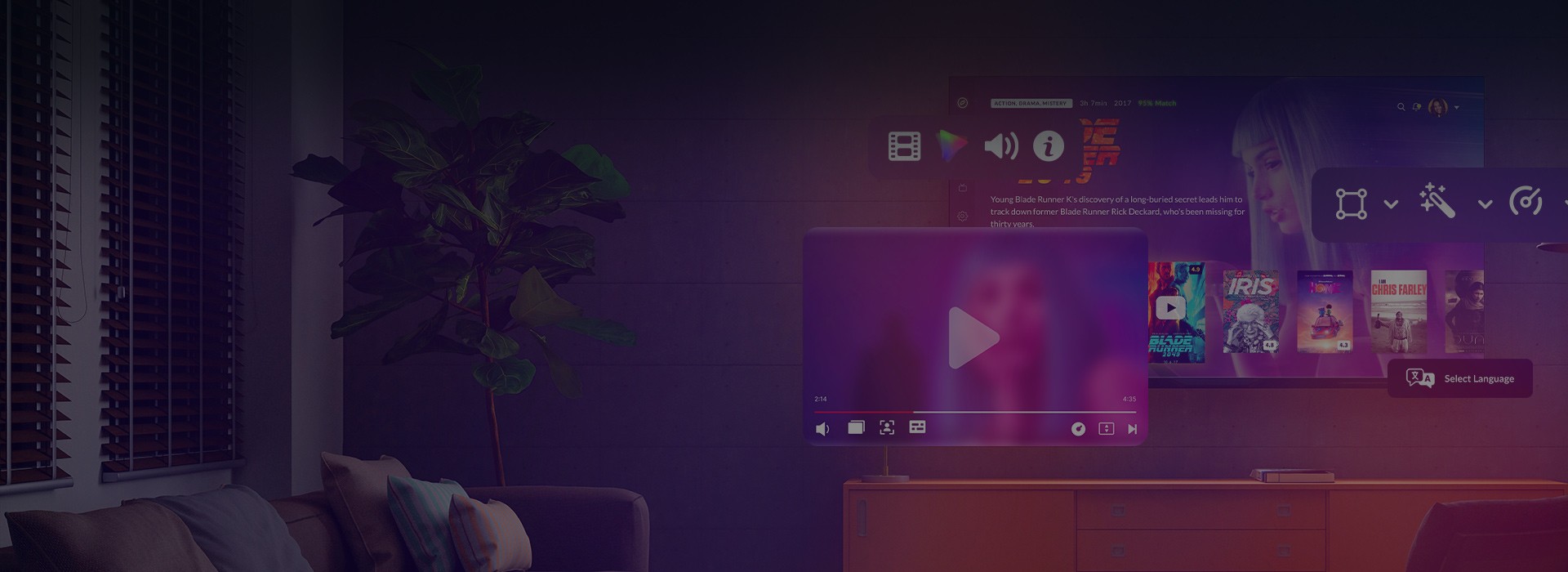

Video streaming

We create video solutions that click with users

About 20 years of delivering technical excellence to the video streaming industry

Learn more

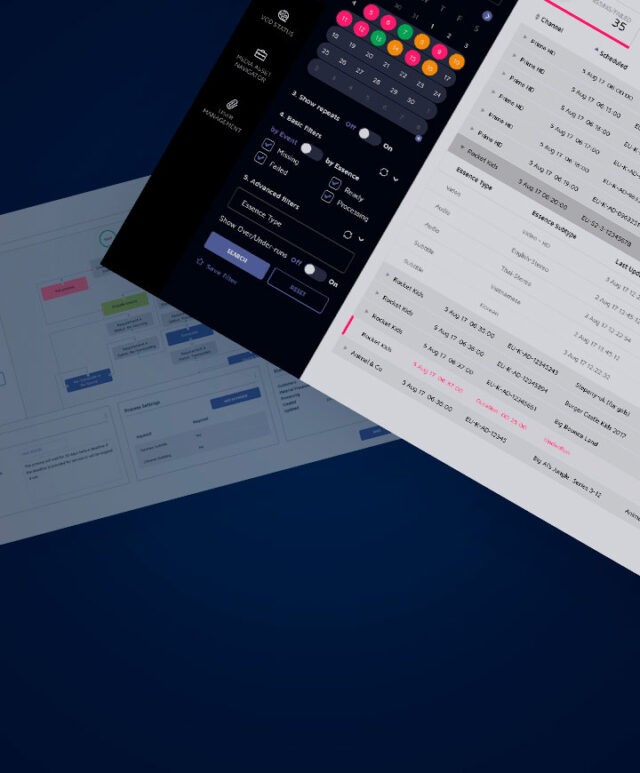

AI

Artificial Intelligence

Feel the power of data and AI synergy

We have a handful of offerings to turn your AI implementation ideas into winning strategies

Learn more

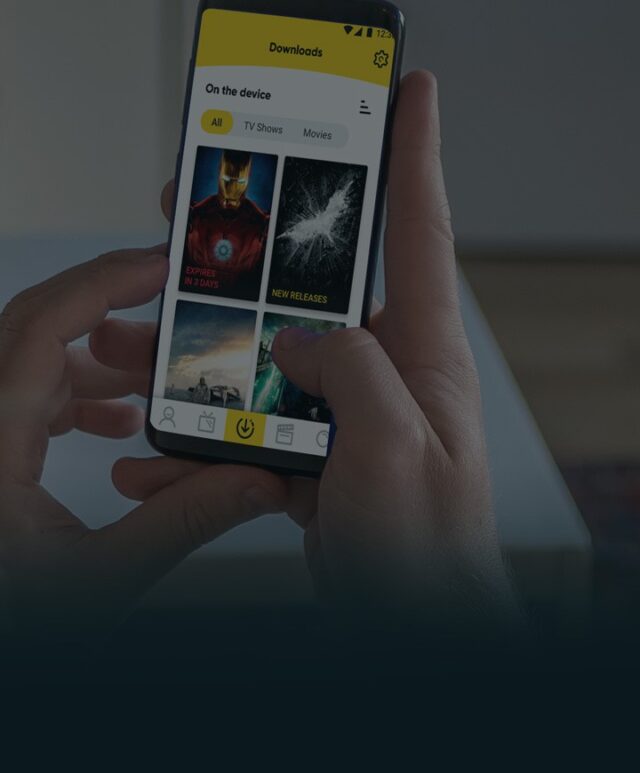

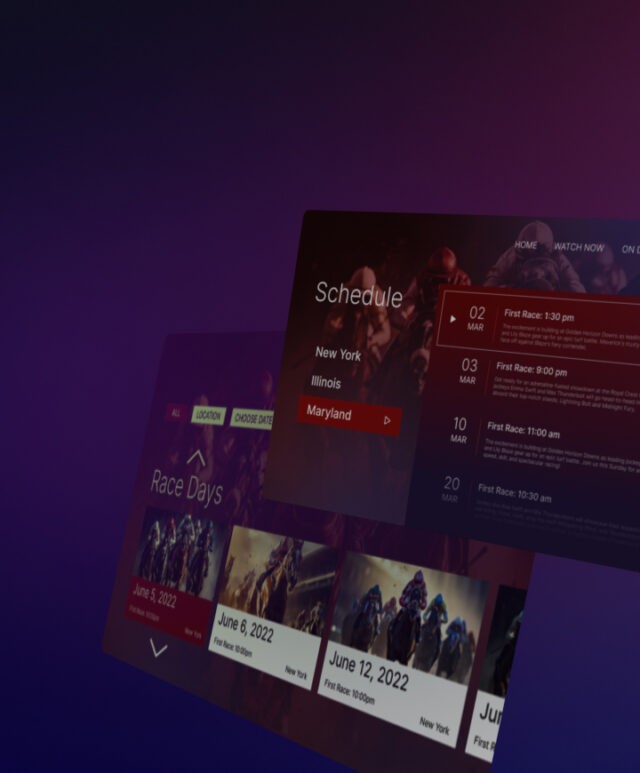

AdTech

AdTech

Custom AdTech for intelligent advertising

360-degree AdTech ecosystem knowledge backed by a 12-year experience in the domain

Learn more

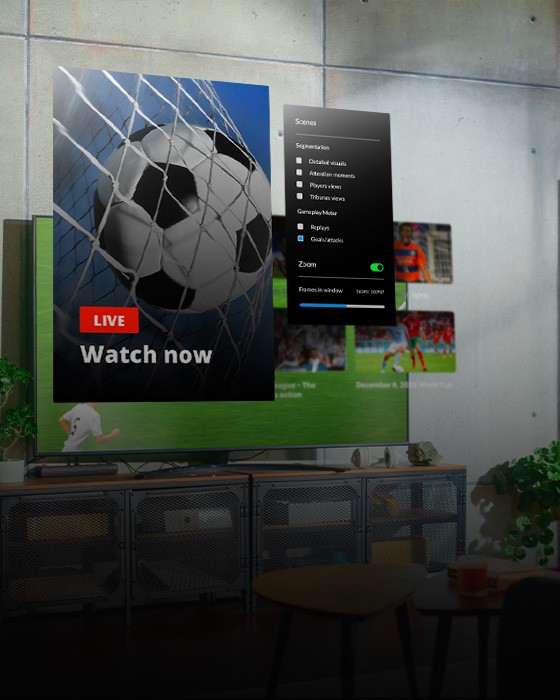

Sports

Sports

Delivering custom sports solutions

Our team creates tailored sports experiences that take on any aspect of the domain

Learn more

Services

Services

Custom software development

We provide full-fledged software development services, from IT consulting and custom software engineering to enterprise-grade integrations and quality assurance

Get a quote Custom Software Solutions Building tailored, domain-specific solutions to unlock business value and ensure a competitive edge Product Development Enabling product ideation, design, growth and distribution across markets Managed Software Engineering Product-minded Agile squads, enterprise-wide program management, digital transformation enablement R&D Applying innovative approaches and ideas at every stage of your software project Quality Assurance Leveraging manual and automated testing capabilities to achieve the highest level of customer satisfaction Scalability of Delivery Scaling and optimizing processes and resources effectively and in line with your needs

Portfolio

Portfolio

450+ clients including Fortune 500 and Forbes 2000 firms

We help global industry leaders, recognized technology innovators, telecoms, content owners, broadcasters, and other clients drive business growth

Explore Projects Company

Company

Continuous value delivery

We enable progressive businesses to transform, scale, and gain competitive advantage with innovative, tailor-made software

Get a quote